philadelphia wage tax for non residents

The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for. Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents.

Bucks County Residents Who Work For Companies Based In Philadelphia May Be Due A City Wage Tax Refund

The rate increase has an immediate impact on.

. Income tax regulations The regulations document puts forth the legal terms of Philadelphias Wage Tax employers. Non-residents who work in Philadelphia must also pay the Wage Tax. The new wage tax rate for non-residents who are subject to the Philadelphia City Wage Tax is 35019.

On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia.

Philadelphia Pennsylvania nonresident Earnings Tax rates decrease effective July 1 2021. Nonresident earnings tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident earnings tax rates will be reduced from the. Nonresident earnings tax rates will be reduced to 34481 percent down from the previous rate of 35019 percent and resident earnings tax rates will be reduced from the.

Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia. Effective July 1 2021 the rate for. All Philadelphia residents owe the City Wage Tax regardless of where they work.

Employers must begin withholding Wage Tax at the new. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481.

Wage Tax for Residents of Philadelphia. In addition non-residents who work in Philadelphia are required to pay the. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services. Tax rate for nonresidents who work in Philadelphia. The Wage and Earnings taxes apply to salaries wages commission and other compensation.

All Philadelphia residents regardless of. 379 0379 Wage Tax. The Wage Tax rate for residents of Philadelphia will remain the same at.

For non-residents the Wage and Earnings Tax rates will be 34481. Income tax regulations - City of Philadelphia. Here are the new rates.

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

I Ve Been Working My Philadelphia Based Job From Home In The Suburbs Do I Need To Pay Philadelphia Wage Tax Canon Capital Management Group Llc

Black Companies Still Need Help Recovering From Pandemic Business Phillytrib Com

Philly Eyes Cuts To City Wage Tax Business Tax Rate Whyy

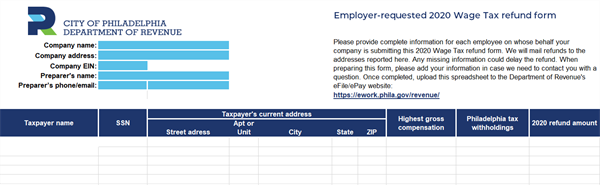

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Philadelphia Wage Tax Q A Covid 19 Policies Brinker Simpson

Dr Michael Knoll Is The Philadelphia Wage Tax Unconstitutional

How To Get Your 2021 Philadelphia City Wage Tax Refund

Philadelphia Wage Tax Reduced Beginning July 1 Department Of Revenue City Of Philadelphia

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Prepare The Annual Reconciliation Of Employer Wage Chegg Com

Astros Players Will Pay Philadelphia Wage Tax For World Series Games At Citizens Bank Park

July 1 2019 Updates To Philadelphia Wage Tax And New Jersey Minimum Wage Canon Capital Management Group Llc

/cloudfront-us-east-1.images.arcpublishing.com/pmn/ZOGOD32VJFF2ZBX5J662HMUQ3A.jpg)

Philadelphia Wage Tax Cut Would Be Smaller For Commuters Than City Residents Under Budget Compromise

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Dr Michael Knoll Is The Philadelphia Wage Tax Unconstitutional

U S Supreme Court Decision Imperils A Portion Of Wage Tax In Philadelphia And Wilmington Officials Unwilling Or Unable To Estimate Likely Budget Impact Whyy